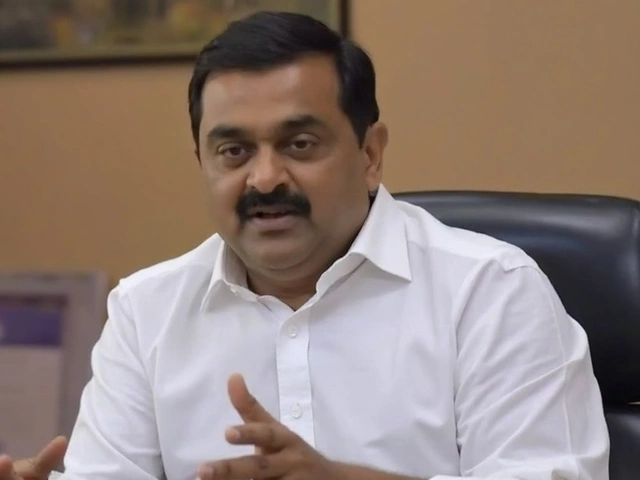

In a dramatic twist of events, Gautam Adani, one of India's wealthiest figures, has found his financial empire under intense scrutiny following a U.S. indictment. The charges, which were made public on November 20, 2024, allege that Adani was at the center of a $265 million bribery plot. This alleged scheme is said to have involved bribing Indian officials to gain favorable solar energy contracts, misleading investors along the way.

Major Financial Repercussions

Following these serious allegations, Adani's financial standing suffered a heavy blow. His net worth, once a source of national pride, tumbled by $12.3 billion within a single day, reducing his fortune to $57.5 billion, according to Forbes. This setback is a stark contrast to his recent efforts at recovery following the earlier 2023 Hindenburg Research scandal.

The market impact was equally brutal. Adani Group's overall market capitalization plummeted by Rs 2.24 lakh crore, which translates to about $26 billion, just a day after the indictment news hit. Nearly all of the Adani Group companies witnessed a steep drop in their stock prices. Particularly, Adani Green Energy had to abort its planned $600 million bond sale, reflecting the mounting investor apprehension.

Legal and International Complications

The legal troubles are multifaceted. The indictment encompasses charges such as securities fraud, wire fraud, and obstruction of justice under the Foreign Corrupt Practices Act (FCPA). The implications of these charges are not limited to potential financial penalties; arrest warrants have been issued against both Gautam Adani and his nephew, Sagar Adani. Although the extradition process is expected to involve foreign law enforcement, it clearly indicates the seriousness of the case.

To add to the contentious legal battle, the U.S. Securities and Exchange Commission (SEC) has filed a civil suit echoing similar allegations. The SEC accuses Adani and his associates of misleading U.S. investors by misrepresenting their anti-bribery compliance measures, a claim that significantly complicates the group's defenses.

Amidst these allegations, prosecutors presented what they termed as 'bribe notes' found on devices belonging to Sagar Adani, detailing communications and alleged payment plans to government officials in various Indian states like Andhra Pradesh, Odisha, and Tamil Nadu.

Facing this storm, the Adani Group has publicly rejected all accusations, labeling them as 'baseless' while committing to pursue all available legal avenues to dispute the charges. However, experts think that the group's access to international funding could face restrictions until these legal matters are settled.